If you’ve ever visited the Minnesota Judicial Branch’s website (and if you’re stuck in a legal quandary with judgment collection as part of the agenda you must have), you’ll see that they really do try to help you. They have a full “key” that explains the different terminology involved, they explain that the judgment can last 10 years, and they answer many questions on their “Help” page. You might think that these easy resources could pave the path toward judgment collection as something that was easier—but you couldn’t have been more wrong.

The Many Challenges You’ll End up Facing

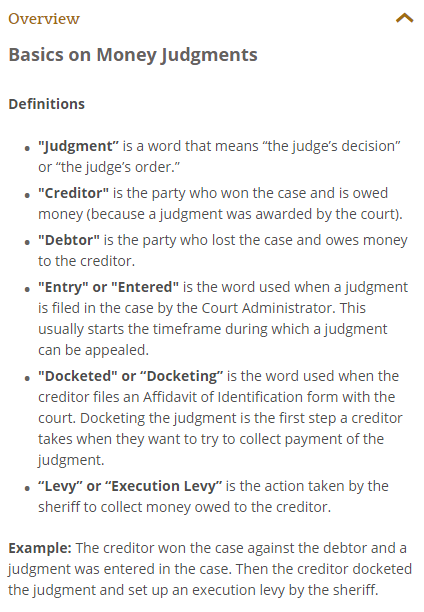

It starts, of course, with not knowing how debt collection works nor knowing how to make it work. You have won the judgment, well and good, but what next? Do you have the time and mettle needed to collect it? Will you be easily intimidated by the debtor if they tried? How will you fare if the debtor resides cross-state, such as in Minnesota? Can you deal with all the legal particulars involved?

Then, of course, there are more challenges that are never too far: can you find out all the information about the debtor that you need and that too accurately? What if the debtor keeps moving constantly and keeps evading your net? What if the debtor files for bankruptcy?

Perhaps, you think, that thanks to technology, you’ll have more ways of finding more information—for sure, you will. But can you and how soon can you verify all this information is the real question here.

The Stages to Getting to a Debtor

This generation of debtors is very different from those we had had to deal with in the past. Not only are they more tech-savvy, they also have far more resources that will help them in evading the creditor. You, as the creditor, will have to collect information, sift through it, identify, and locate elusive debtors before you can even begin with the rest of the procedure.

Worse still, is the scenario where the debtor resides outside your state: because that means you’ll need to cross state lines, access public records, discover assets in the debtor’s name, so on and so forth.

Too Much of a Hassle

If you think that all of this sounds like too much of a hassle, you aren’t wrong. It is too much of a hassle but not for a judgment collection firm like Judgment Minnesota.

We have access to public records and can fish out information without having to waste unnecessary time in the process. We have the tech, software, and the manual mettle needed to tackle debtors.

In short, we’re trained to do this job. We can make the job easier for you too by buying judgments from you and paying you in cash. Get in touch with us should you be interested.

Leave A Comment